Que es la acción pauliana? It is a legal action that allows creditors to challenge and reverse fraudulent transfers of assets made by debtors to avoid paying their debts. This action plays a crucial role in protecting creditors from unscrupulous debtors who attempt to evade their financial obligations.

Understanding the elements, purpose, and procedure of Pauliana actions is essential for creditors seeking to recover their losses. This article delves into the intricacies of Pauliana actions, providing valuable insights for creditors and debtors alike.

Definition of Pauliana Action

A Pauliana action is a legal action that allows creditors to challenge transactions made by a debtor that were intended to defraud them.

For example, if a debtor sells their assets to a third party for less than their fair market value in order to avoid paying their creditors, the creditors may be able to bring a Pauliana action to have the sale set aside.

Elements of a Pauliana Action

In order to succeed in a Pauliana action, the creditor must prove that:

- The debtor made the transaction with the intent to defraud their creditors.

- The debtor was insolvent at the time of the transaction.

- The creditor was harmed by the transaction.

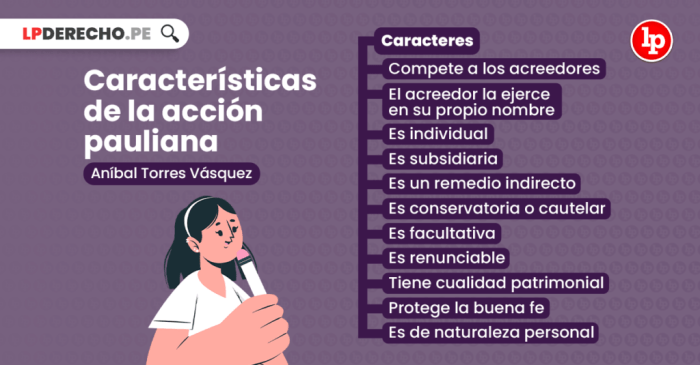

Purpose of Pauliana Action

The Pauliana action is a legal remedy that allows creditors to challenge fraudulent transfers of property made by their debtors. It is designed to protect creditors from situations where debtors attempt to avoid paying their debts by transferring their assets to third parties.

Que es la acción pauliana? Basically, it’s a legal mechanism to recover assets that have been fraudulently transferred. Think of it as a way to undo shady deals. If you’re interested in digging deeper into this topic, check out this apes unit 8 study guide . It’s got all the juicy details you need to know about que es la acción pauliana and more.

How Pauliana Action Protects Creditors

The Pauliana action protects creditors by allowing them to:

- Recover assets that have been fraudulently transferred

- Prevent debtors from transferring assets in anticipation of a lawsuit

- Hold third parties who knowingly participate in fraudulent transfers liable

Elements of Pauliana Action: Que Es La Acción Pauliana

To establish a Pauliana action, several elements must be proven.

The burden of proof for each element lies with the party asserting the Pauliana action, typically the creditor.

Existence of Debt

- The creditor must demonstrate the existence of a valid and enforceable debt owed by the debtor.

- This may involve presenting evidence of a loan agreement, invoice, or other documentation establishing the debt.

Fraudulent Transfer

- The creditor must prove that the debtor transferred assets with the intent to hinder, delay, or defraud creditors.

- Evidence of fraudulent intent may include the debtor’s financial condition, the timing of the transfer, and the relationship between the debtor and the transferee.

Injury to Creditor

- The creditor must show that the fraudulent transfer resulted in an injury to the creditor.

- This may involve demonstrating that the creditor was unable to collect on the debt due to the transfer.

Procedure for Pauliana Action

Filing a Pauliana action involves several steps, and it is crucial to adhere to specific time limitations.

Initiation of the Action

The process begins with filing a complaint in court, which should clearly state the grounds for the action and provide evidence to support the claims. The complaint should also identify the fraudulent transfer and the parties involved.

Service of Process

Once the complaint is filed, the defendant must be served with a copy of the complaint and a summons. This notifies the defendant of the action and gives them an opportunity to respond.

Discovery

After service of process, both parties engage in discovery, which involves exchanging information and documents relevant to the case. This process helps each party prepare for trial.

Trial

If the case cannot be resolved through settlement, it will proceed to trial. At trial, both parties present their evidence and arguments to the court, which then makes a decision based on the evidence presented.

Time Limitations, Que es la acción pauliana

There are strict time limitations for filing a Pauliana action. The action must be filed within one year of the fraudulent transfer. If the action is not filed within this time frame, the court may dismiss it.

Defenses to Pauliana Action

Defenses to a Pauliana action are strategies or arguments used by the defendant (debtor) to counter the allegations of the plaintiff (creditor). By raising these defenses, the defendant aims to protect their assets and avoid the invalidation of transactions that are alleged to be fraudulent.There

are several common defenses to a Pauliana action:

Lack of Intent to Defraud

The defendant may argue that they did not have the intent to defraud the creditor when the transaction was made. This defense requires the defendant to demonstrate that they genuinely believed that they could fulfill their obligations to the creditor at the time of the transaction.

Fair Consideration

The defendant may assert that they received fair consideration for the transfer of assets in question. This means that the defendant exchanged something of value, such as money or property, in return for the assets. If the defendant can show that the consideration was fair and reasonable, the transaction may not be considered fraudulent.

Adequate Solvency

The defendant may argue that they were solvent at the time of the transaction. This means that they had sufficient assets to cover their debts, even after the transfer of the assets in question. If the defendant can demonstrate solvency, the transaction may not be considered fraudulent.

Statute of Limitations

The defendant may assert that the statute of limitations has expired for bringing a Pauliana action. In most jurisdictions, there is a time limit within which a creditor must file a Pauliana action. If the creditor fails to file within this time period, the action may be barred.

Remedies for Pauliana Action

Upon a successful Pauliana action, the court may grant various remedies to restore the financial status of the creditor and protect the interests of other creditors. The choice of remedy depends on the specific circumstances of the case.

The primary objective of the remedies is to nullify the fraudulent transfer and restore the creditor’s rights over the transferred property.

Recovery of the Transferred Property

- The court may order the return of the fraudulently transferred property to the creditor.

- If the property has been sold or transferred to a third party, the court may order the recovery of the proceeds or equivalent value.

Compensation for Damages

- The creditor may be awarded damages to compensate for any financial losses suffered as a result of the fraudulent transfer.

- Damages may include the value of the transferred property, lost profits, and other expenses incurred.

Setting Aside the Transfer

- The court may declare the fraudulent transfer void and set it aside.

- This remedy effectively cancels the transfer and restores the property to the debtor’s estate.

Factors Considered in Determining the Remedy

- The nature and value of the transferred property

- The extent of the creditor’s damages

- The financial condition of the debtor

- The rights of other creditors

- The intentions of the debtor and transferee

Quick FAQs

What is the purpose of a Pauliana action?

A Pauliana action allows creditors to challenge and reverse fraudulent transfers of assets made by debtors to avoid paying their debts.

What are the elements that must be proven to establish a Pauliana action?

To establish a Pauliana action, creditors must prove that the transfer was made with the intent to defraud creditors, that the debtor was insolvent at the time of the transfer, and that the creditor was prejudiced by the transfer.

What are the common defenses to a Pauliana action?

Common defenses to a Pauliana action include lack of fraudulent intent, solvency of the debtor at the time of the transfer, and lack of prejudice to the creditor.